The high stakes of expanding without insight

Reading Time: < 1 minute

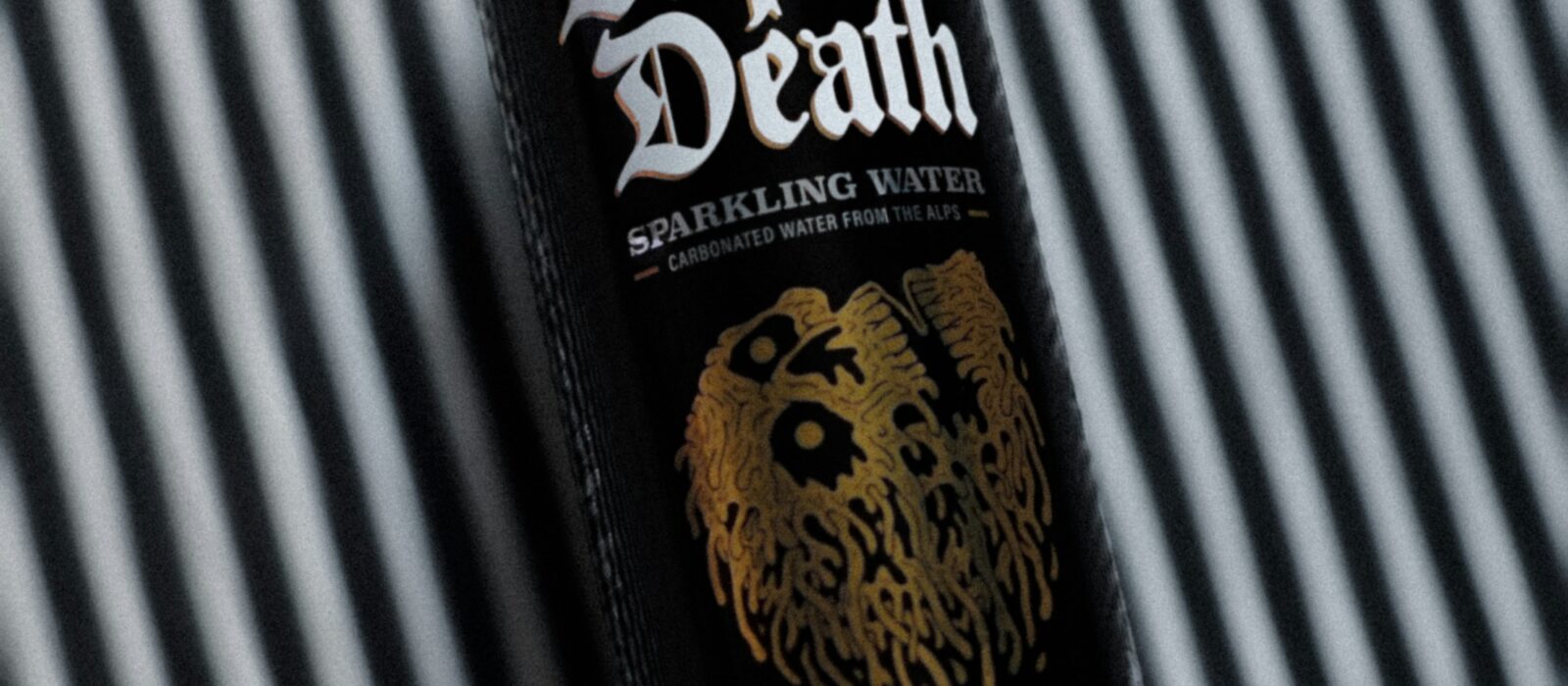

In a bold and unconventional move, Liquid Death, the canned water brand known for its edgy marketing and irreverent approach to branding, has announced its decision to exit the UK market. The news comes as a surprise to many, given the brand’s meteoric rise in the U.S. and its rapid expansion into other global markets.

Liquid Death made waves with its provocative branding, positioning itself as an alternative to traditional bottled water. With its heavy metal aesthetic, humour-laden campaigns, and the audacious tagline “Murder Your Thirst,” the brand appealed to a younger, counterculture audience. This strategy worked wonders in the U.S., where it quickly became a cultural phenomenon, capturing the attention of millennials and Gen Z with its irreverent attitude and strong commitment to environmental sustainability.

However, Liquid Death’s UK venture, which began with much fanfare, has struggled to gain the same traction. So, what went wrong?

One of the main reasons for Liquid Death’s failure in the UK lies in its misunderstanding of the cultural differences between the U.S. and the UK. The heavy metal, anarchistic vibes that have worked so well in America didn’t necessarily translate to the UK’s more reserved approach to marketing. The British public, known for its dry humour and subtlety, may have found the brand’s approach too over-the-top or out of touch with local sensibilities.

Interestingly, I witnessed this firsthand when Liquid Death’s brash, in-your-face marketing failed to land with an audience who should have been the bullseye of their target market. Where else should ‘heavy metal water’ expect to land better than at Download Festival, arguably the home of heavy metal?

The brand had a large presence at the festival in 2023, with ads blasting from the additional arena screens – so frequently, in fact, they became a meme amongst attendees. Their iconic cans were stocked at all festival bars but were largely met with a ‘what’s this?’ confusion. In 2024, Liquid Death took things further and became the festival’s first ever ‘headline partner’, rebranding the event as ‘Liquid Death presents Download Festival’. This did not go down well with the Download audience – after all, corporate sponsorship is pretty antithetical to rock and roll!

Another factor that likely contributed to the brand’s struggles in the UK is the inherent challenge of the bottled water market itself. While the U.S. has embraced the idea of premium water brands like Liquid Death, the UK market is more saturated with well-established local options.

There’s also a clue in the category title – “bottled water”. The average UK shopper is not looking for a can of water, as the 500ml size and bold pack design are more commonly associated with energy drinks or niche craft beers. It’s possible Liquid Death was too unconventional for the UK water category, overlooked simply because shoppers didn’t realise what it was.

At around £5 for a four-pack, Liquid Death’s higher price point may have deterred budget-conscious UK consumers, especially when they had access to more economical, locally produced alternatives. A novelty pack format and some fun can designs failed to cut through in a post-pandemic, cost of living crisis UK market, where consumers could buy an eight-pack of Highland Spring for £3.00.

Beyond the anarchy, talk of murder, and bold branding, Liquid Death had a softer side – its sustainability pledges (although this too was still done in typical Liquid Death style with its ‘death to plastic’ movement).

The issue? UK customers have access to the most sustainable and affordable drinking water option – high quality tap water.

When sustainability is weighed against price, the math simply didn’t add up:

£1.25 for a can of sustainable water vs refilling my own water bottle for free.

Additionally, despite growing concern for sustainability, UK consumers tend to approach bold claims with a healthy dose of skepticism. Liquid Death’s approach may have come off as more of a marketing gimmick rather than a genuine commitment to the cause.

Liquid Death’s exit from the UK is a reminder of the importance of market research and cultural understanding when expanding into new .

While a bold, disruptive marketing strategy may work wonders in one market, it’s crucial to understand the nuances of local tastes, values, and consumer behaviour. Adapting a brand’s message and product offering to fit the needs of a specific region, rather than simply applying a one-size-fits-all formula, is key to long-term success.

Our Market Map solution provides a comprehensive view of your market, helping you:

With a modular, flexible approach, Market Map delivers actionable insights – whether you’re entering new markets, refining strategies, or validating new ideas. Get in touch to learn more.

Check out my first blog in this series, where I explore the story of the UK’s favourite supermarket and its attempt to crack the U.S. market – plus some key lessons learned.

Liss Myers

Insight Director